Innovating To Fund Care - FinTech meets AgeTech

Sep 28, 2022

By Sanjay Khurana, Investor-in-Residence, Techstars Future of Longevity Accelerator

Older adults might soon outnumber children for the first time in U.S. history. With 10,000 baby boomers turning 65 every day, all boomers will be over 65 by 2030. This will amount to 1 in every 5 Americans. Boomers hold over 53% or close to $60 trillion of generational wealth. They are 10 times wealthier than millennials and twice as wealthy as Gen X. According to AARP, the economic and societal contribution of Americans aged 50+ is worth over $9 trillion in 2018 and is projected to grow.

That said, older adults face serious challenges as care is becoming more expensive and complex to navigate, and few Americans have saved enough money to pay for additional support for the duration of their retirement.

01. Long Term Care is a huge, unplanned financial burden for older adults and their families

Long Term Care is the care you may need if you are unable to perform daily activities on your own. Depending on one’s situation, care is provided in different settings: in-home (homemaker providing iADL care and home aide providing ADL care), community (adult day care), and facility (assisted living and nursing homes). According to the HHS, 70% of people over the age of 65 will need some type of long-term care support - an expense not covered under Medicare, Medicare Advantage, or Medicare Supplemental Insurance. Unfortunately, few Americans have saved enough money to pay for outside help during their retirement.

The Long Term Care Insurance (LTCI) industry has witnessed a significant decline in options for older adults. Only 11% of adults over age 65 have long-term care insurance. Despite the growing need, the number of insurers offering LTCI coverage has decreased from ~ 100 in 2004 to about a dozen in 2020. The LTCI downturn is due to rising claims, low mortality, and lower-than-expected lapses, leading to higher prices, often unaffordable to a large segment of the affected population (NAIC).

02. Rising cost of care challenges older adults’ desire to age at home

While nearly 77% of adults 50+ want to remain in their homes for the long term (AARP), the cost of care at home for when they need might not be so affordable for most on a fixed income. The annual median cost for home health aides grew in 2021 by 12.5% to $61.6K, and homemaker services increased by 10.64% to $59.5K, a growing expense for those aging in place (Genworth). Despite Medicare coverage, most long-term services and supports are generally provided by familial caregivers who bear the brunt of the care. 66% of caregivers use their retirement and savings funds to pay for care (Genworth).

The high turnover rate and insufficient supply of care professionals to meet this growing demand continue to drive in-home and facility-based costs of care. By 2030 the national annual median costs are expected to see a 30% increase compared to those in 2021 - homemaker services ($77.6K), home health aide ($80.6K), adult day care ($26.5K), assisted living ($70.5K) and nursing Home ($123.8K-$141.4K).

03. Financial challenges facing caregivers in America

Currently, over 53 million Americans serve as unpaid caregivers for family members. U.S. family caregivers provide $470 billion in unpaid care (AARP). Caregiving can take not only a physical and emotional toll, but it can also have a financial one as well. 78% of caregivers report having out-of-pocket expenses as a result of caregiving, spending on average 26% of their income on caregiving activities. The top three expenses on behalf of their loved ones are rent/mortgage (30%), home modification (21%), and medical costs (17%).

Two-thirds of these caregivers are women, and women are three times as likely as men to quit their jobs to take care of a family member (AARP). The pandemic has heightened caregiver strain. More than 40% of caregivers report spending both more time per week and more money on caregiving as a result of the pandemic. 10% of caregivers who live with the person they care for say they moved in together due to the pandemic.

Unfortunately, this care comes at a huge personal cost to caregivers, including lost wages and benefits. Many spend thousands of dollars out of pocket each year on their care recipients, often to the detriment of their financial security and retirement savings. According to Metlife, 10 million caregivers aged 50+ who care for their parents lose an estimated $3 trillion in wages, pensions, retirement funds, and benefits.

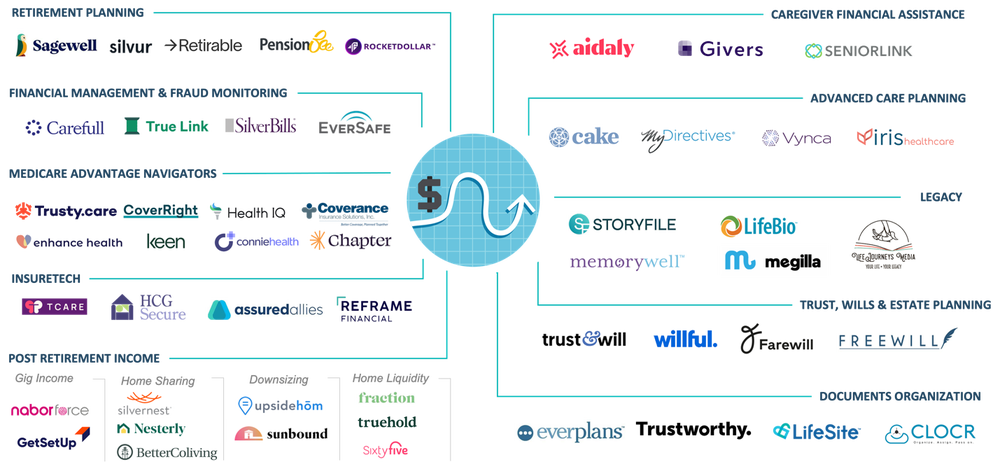

04. Market Innovation in Financial Resilience

The space at the intersection of Fintech and AgeTech has seen a flurry of startups in the last few years. Broadly termed, financial resilience covers products and services across all aspects of Aging: retirement savings & planning, elder fraud, Medicare Advantage insurance navigation, Hybrid LTC insurance, post-retirement income generation, caregiver financial assistance, and legal and financial planning services.

05. Five key takeaways for entrepreneurs:

There is no silver bullet to fund care. However, there are valuable resources and channels one should consider as you develop new business models and technical solutions to solve this fragmentation to unlock savings and simplify access.

1. “How might we - simplify the process of discovery, eligibility, and access to financial assistance”

While not the easiest to navigate, there are public and private assistance programs available to assist family caregivers in the care of older adults. These assistance programs vary widely by state and one’s circumstances. Examples include the Veteran’s Caregiver Assistance program, Medicaid Home and Community Based (HCBS) waiver programs (for ADL support, iADL support, home modification, special equipment, assistive devices, or technology), self-directed Medicaid waivers to get paid as a caregiver, BenefitsCheckUp a free service provided by the NCOA allows elders to see if they qualify for more than 2,500 federal, state and private benefits programs, Area Agencies on Aging (AAA) that serve seniors, individuals with disabilities and family caregivers in a designated area, etc. For those enrolled in Medicare Advantage (MA) plans, helping beneficiaries and caregivers access supplemental benefits (meals, transportation, caregiver support, bathroom safety devices, PERS devices, adult-day, in-home supports, etc.) can help reduce out-of-pocket spending.

2. “How might we - build a new care insurance model”

We have seen small innovations, in light of the challenges facing the traditional LTCI industry. This includes the development of new short-term care insurance to hybrid insurance products, as well as LTC financing policies (NAIC). Acknowledging there are strict underwriting procedures and regulations that go into developing an insurance product, what if we reimagined a new care insurance product that is truly designed to encourage and support care in the home, one that is easy to communicate and provides more consumer protection? Imagine if an insurance company conducts an annual home assessment, and proactively adds grab bars in the bathroom to prevent falls for someone who is at high risk of falls.

3. “How might we - support the health and financial wellbeing of working caregivers”

The pandemic shone a light on both the emotional and financial sacrifices family caregivers (especially women), make every day to help their family members. 61% of caregivers work full-time caring for someone over the age of 50 (AARP). The cost to employers of absenteeism, workplace disruptions, and reduced work status of working family caregivers is estimated to result in losses between $34-$38 billion annually (MetLife). Employers are looking to create a stronger bond with their workforce by offering health and well-being benefits, including financial resources that their employees will value.

4. “How might we - rethink housing and funding care”

Nearly 80% of older adults aged 65+ own their homes. (U.S. Census, 2020), and the average home equity for a senior homeowner aged 65+ is $143,500. (Joint Center for Housing Studies, 2019). Many older adults own their homes but struggle to make ends meet due to limited income. Accessing home equity and shared housing models can be a useful financial tool for some older homeowners to age in place and pay for care, but establishing consumer trust in offering solutions in these areas is paramount.

5. “How might we - create meaningful employment opportunities for older adults"

Many older adults age 65+ continue to work for years after the traditional retirement age. The U.S. Bureau of Labor Statistics (BLS) projects that by 2024 - 13 million people age 65 and older will still be working. The reasons these adults continue to work past traditional retirement ages are varied and personal. Some stay employed to build savings for retirement or to delay claiming Social Security benefits, and others do it for personal fulfillment and purpose. How do we create platforms for retaining and harnessing this talented workforce?

06. Call for Innovation

With a central focus on being able to fund, save and pay for long-term supports services that would allow older adults and caregivers to thrive at home and in the community, three areas are ripe for innovation:

Funding Care: Emerging models of funding care that pay the family caregiver for care provided by leveraging public/private entitlements and/or waivers, caregiver marketplaces that help navigate choices of products and services, care insurance product alternatives to traditional LTCI, integrated care insurance products that provide care-coordination & home support services as a way of keeping policyholders and allowing them to age safely at home.

Supplemental Income for Retirees: Models that provide supplemental income for older adults not just as means of paying for care, but also as a way of providing purpose and companionship; examples include gig income generation, home sharing, home liquidity, etc.

Extending Quality Aging at Home: A broad category of products and services that allow caregivers and older adults they care for to live independently for as long as possible in their homes. Examples include solutions like home safety/modifications, fraud monitoring, getting legal (advanced directives, trust, wills) and personal (legacy, insurance, etc.) documents in order, access to free/subsidized community resources, navigating Medicare plan selection, and accessing plan benefits. Care insurance products that integrate care coordination and home services could find a unique way to defray long-term care costs in nursing homes and assisted living facilities.

The term “aging in place” for me fails to convey the true sentiment of older adults’ desire to live socially vibrant lives in the community for as long as they can. I much prefer to call it “thriving at home and in the community”. Regardless of what we call it, for most Americans, our desire to live independently doesn’t quite align with our ability to afford it. Few have saved enough money to pay for additional care they need to live safely and independently at home, and with the rising cost of care, this luxury is for the few. Unfortunately, this care also comes at a huge personal cost to caregivers, often to the detriment of their financial security and retirement savings. The hope is that market-led innovations can break this cycle with solutions designed to improve affordable access to financial resilience for those who most need it – the ones in the middle who neither have the safety net of Medicaid nor have the savings to pay for it.

About Techstars

The Techstars worldwide network helps entrepreneurs succeed. Founded in 2006, Techstars began with three simple ideas—entrepreneurs create a better future for everyone, collaboration drives innovation, and great ideas can come from anywhere. Now we are on a mission to enable every person on the planet to contribute to, and benefit from, the success of entrepreneurs. In addition to operating accelerator programs and venture capital funds, we do this by connecting startups, investors, corporations, and cities to help build thriving startup communities. Techstars has invested in more than 4,000 companies with a combined market cap of $106B. www.techstars.com

About Pivotal Ventures

Pivotal Ventures, a Melinda French Gates company, accelerates social progress in the United States. We remove barriers to equality and opportunity through investments, partnerships, and advocacy.

About the Author

Sanjay Khurana

Sanjay spent his career building and delivering innovative products and delightful consumer experiences at companies from Fortune 5 to tech start-ups. He has held senior leadership roles in product development, innovation, strategy, and new business ventures development in digital health, consumer technologies, media and communications. Previously he's held positions at CVS Health, as Vice President of Caregiving Products and Services at AARP, and Director of Innovation and Thought Leadership at AARP.